Blog Title: Saudi Arabia Oil & Gas Equipment: Procurement Best Practices

Meta Title: Saudi Arabia Oil & Gas Equipment Procurement Best Practices 2025

Meta Description: Guide to procuring oil & gas equipment in Saudi Arabia. Aramco standards, IKTVA program, suppliers, logistics. Complete procurement guide.

Keywords: oil and gas equipment Saudi Arabia, Saudi Aramco suppliers, IKTVA program, Riyadh industrial equipment

Saudi Arabia Oil & Gas Equipment: Procurement Best Practices

The Kingdom of Saudi Arabia, the world's largest oil exporter and second-largest proven oil reserves holder, represents the single most critical market for oil and gas equipment Saudi Arabia suppliers. The procurement landscape is characterized by high technical standards, stringent regulatory compliance, and a strategic national imperative to localize value, primarily driven by Saudi Aramco and the Vision 2030 program.

This comprehensive guide is designed for international manufacturers and suppliers seeking to navigate the complexities of the Saudi Arabian oil and gas procurement ecosystem. Adherence to established protocols, particularly those set by Saudi Aramco, is not merely a suggestion but a fundamental prerequisite for market entry and sustained success.

The Strategic Importance of the Saudi Oil & Gas Sector

The Saudi Arabian oil and gas sector is the backbone of the nation's economy. State-owned Saudi Aramco, the world's largest integrated energy and chemical company, dominates the industry, driving massive capital expenditure in upstream, midstream, and downstream projects.

Vision 2030 has amplified this spending, focusing on expanding gas production, increasing refining and petrochemical capacity, and diversifying the energy mix. This sustained investment creates a robust and continuous demand for advanced, high-quality industrial equipment, making the market highly lucrative for qualified international suppliers. The sheer scale of operations—from the Ghawar field to complex offshore projects—demands a resilient and technically proficient supply chain.

Adherence to Saudi Aramco Standards (SAES)

For any supplier targeting the Saudi market, compliance with Saudi Aramco standards (SAES) is paramount. SAES are a comprehensive set of engineering specifications and requirements that govern the design, materials, construction, and inspection of all facilities and equipment within Aramco's operations. These standards often exceed international benchmarks (such as API, ASTM, ISO) and are rigorously enforced.

Understanding the SAES Framework

The SAES documents cover virtually every aspect of oil and gas operations. Key areas of focus for equipment suppliers include:

- SAES-A Series (General Engineering): Covers general requirements, including design criteria, safety, and quality assurance.

- SAES-B Series (Mechanical): Critical for pressure vessels, piping, heat exchangers, and rotating equipment. This series dictates material selection, fabrication, and testing protocols.

- SAES-J Series (Instrumentation and Control): Essential for suppliers of control systems, sensors, and monitoring equipment.

- SAES-L Series (Piping): Specifies requirements for pipeline systems, including material, welding, and non-destructive testing (NDT).

- SAES-P Series (Electrical): Covers electrical installations, power generation, and distribution equipment.

[IMAGE: Schematic diagram illustrating the hierarchy of Saudi Aramco standards (SAES) and their relationship to international codes (e.g., API, ASME).]

The Importance of Vendor Inspection

Saudi Aramco maintains a strict vendor inspection process. Before any equipment can be supplied, the manufacturer's facility and quality management system must be audited and approved by Aramco's Inspection Department. This involves:

- Vendor Registration: Initial qualification based on financial stability, technical capability, and quality certifications (e.g., ISO 9001).

- Pre-Qualification: Specific product lines are qualified based on compliance with relevant SAES.

- Manufacturing Surveillance: Aramco inspectors or third-party agencies (TPAs) monitor the manufacturing process, from raw material inspection to final functional testing, ensuring strict adherence to the Purchase Order specifications and SAES.

Failure to meet even minor SAES requirements can lead to rejection of equipment, significant project delays, and financial penalties.

The IKTVA Program Requirements

The In-Kingdom Total Value Add (IKTVA program) is a cornerstone of Saudi Aramco's strategy, designed to localize the energy supply chain and boost economic diversification under Vision 2030. For international suppliers, IKTVA compliance is increasingly becoming a mandatory component of winning major contracts.

What is IKTVA?

IKTVA measures a supplier's contribution to the Saudi economy across four main pillars:

- Localization of Goods and Services: The percentage of a supplier's revenue spent on local goods, services, and manufacturing.

- Training and Development: Investment in training Saudi nationals.

- Employment of Saudi Nationals: The percentage of Saudi citizens in the workforce.

- Research and Development (R&D): Local R&D and technology transfer activities.

[IMAGE: Infographic showing the four pillars of the IKTVA program and their relative weighting.]

Strategic Compliance for International Suppliers

To achieve a high IKTVA score and remain competitive, international suppliers must develop a clear localization strategy. This often involves:

- Establishing a Local Entity: Setting up a manufacturing, assembly, or service facility in Saudi Arabia. This is the most direct way to increase local spend.

- Local Sourcing: Prioritizing the procurement of raw materials, components, and services from local Saudi Aramco suppliers.

- Joint Ventures (JVs) and Partnerships: Collaborating with established Saudi companies to leverage their local presence and network.

- Workforce Development: Implementing robust training programs for Saudi engineers and technicians.

The IKTVA score is reported annually and directly influences a supplier's ranking and eligibility for future Aramco tenders. Suppliers of Riyadh industrial equipment and other major components must treat IKTVA as a core business requirement, not just a regulatory hurdle.

Key Equipment Categories in Demand

The demand for oil and gas equipment Saudi Arabia is vast and covers the entire value chain. Suppliers should focus on high-demand, high-value categories where technical expertise and compliance are critical:

| Equipment Category | Key Applications | Compliance Focus |

|---|---|---|

| Rotating Equipment | Pumps (centrifugal, reciprocating), compressors, turbines, generators. | SAES-D, SAES-G, API standards, high efficiency requirements. |

| Process Equipment | Heat exchangers, pressure vessels, reactors, separators, storage tanks. | SAES-A, SAES-B, ASME Boiler and Pressure Vessel Code (BPVC). |

| Piping & Valves | Line pipe, fittings, flanges, ball valves, gate valves, control valves. | SAES-L series, material traceability, NACE for sour service. |

| Drilling & Well Services | Drill bits, casings, cementing equipment, logging tools, downhole equipment. | API specifications, robust QA/QC for extreme downhole environments. |

| Electrical & Instrumentation | Transformers, switchgear, control panels, DCS/PLC systems, sensors, flow meters. | SAES-P, SAES-J, IEC standards, hazardous area (ATEX/IECEx) certifications. |

Procurement Channels and Strategies

Procurement in the Saudi oil and gas sector is highly structured. Suppliers typically engage through one of two primary channels:

1. Direct Procurement (Saudi Aramco)

Direct engagement with Saudi Aramco is the most common path for high-value, specialized equipment. This requires the supplier to be fully registered and qualified as an approved vendor. The process involves:

- Tender Participation: Responding to specific Invitations to Bid (ITBs) for major projects.

- Long-Term Agreements (LTAs): Securing multi-year contracts for the supply of common, recurring equipment. LTAs provide stable revenue and a strong market position.

- e-Sourcing: Utilizing Aramco's digital procurement platforms for smaller, routine purchases.

2. EPC Contractor Procurement

A significant volume of equipment is procured indirectly through Engineering, Procurement, and Construction (EPC) contractors. These contractors, often international firms, manage the execution of large projects and source equipment from their own pre-approved vendor lists.

Strategy: Suppliers should aim to be approved not only by Saudi Aramco but also by the major international EPC firms (e.g., TechnipFMC, Saipem, Samsung Engineering) that are active in the Kingdom. This dual qualification provides multiple avenues for sales.

Supplier Qualification Requirements

The qualification process for Saudi Aramco suppliers is demanding and multi-faceted. Beyond technical compliance, suppliers must demonstrate organizational maturity and financial stability.

Key Documentation and Certifications

- Commercial Registration (CR): A valid CR in Saudi Arabia is often required, especially for local entities or those engaging in service contracts.

- Quality Management System: ISO 9001 certification is the minimum requirement. Specific industry certifications (e.g., API Q1, AS9100) are mandatory for certain equipment.

- Financial Health: Demonstration of strong financial performance and capacity to handle large contracts.

- HSE (Health, Safety, and Environment) Compliance: A robust HSE management system is non-negotiable and subject to rigorous audit.

- Technical Data Sheets and References: Detailed technical specifications, performance data, and a track record of successful supply to major international oil companies (IOCs).

Import and Customs (SABER)

The import of industrial equipment into Saudi Arabia is regulated by the Saudi Standards, Metrology and Quality Organization (SASO) through the SABER electronic platform. SABER is mandatory for all imported goods and is crucial for smooth customs clearance.

The SABER Certification Process

The process requires two main certificates:

-

Product Certificate of Conformity (PCoC):

- Issued for each product model or category.

- Valid for one year.

- Requires testing and conformity assessment by a SASO-approved Conformity Assessment Body (CAB). For highly technical equipment like oil and gas machinery, this assessment is detailed and involves verifying compliance with SASO standards, which often align with or reference SAES.

-

Shipment Certificate of Conformity (SCoC):

- Issued for every specific shipment.

- Confirms that the batch of goods matches the registered PCoC.

- This certificate is essential for the shipment to be cleared by Saudi Customs (FASAH system).

Practical Tip: Suppliers must proactively engage a CAB early in the process. Delays in obtaining the PCoC or SCoC are a primary cause of bottlenecks at Saudi ports. The technical nature of Riyadh industrial equipment means the PCoC process can be lengthy, requiring detailed documentation and potential factory audits.

Logistics to Saudi Arabia

Efficient logistics is critical for maintaining project schedules in the MENA region. Saudi Arabia is served by major ports, primarily Jeddah Islamic Port on the Red Sea and King Abdulaziz Port in Dammam on the Arabian Gulf.

Shipping Modes and Considerations

- Sea Freight: The most common and cost-effective method for heavy industrial equipment. Suppliers must ensure proper packaging (e.g., crating, anti-corrosion protection) to withstand the long transit times and handling at port.

- Air Freight: Used for urgent, high-value, or smaller components (e.g., critical spares). While faster, the cost is significantly higher.

- Inland Transport: Moving equipment from the port (Dammam or Jeddah) to the final project site (often in the Eastern Province or central regions) requires specialized heavy-haul carriers and permits, especially for oversized and overweight cargo.

Note on Shipping: Free shipping to MENA region by sea offers a significant competitive advantage for bulk equipment orders. However, suppliers must clearly define the scope of delivery (e.g., Free On Board (FOB), Cost, Insurance, and Freight (CIF), or Delivered at Place (DAP)). Air shipping available with additional fees should be reserved for time-critical situations.

Payment Terms and Financial Security

Managing payment terms is a crucial aspect of procurement in the MENA region. While Saudi Aramco and major EPCs are highly reliable payers, the contractual terms can be strict.

Common Payment Mechanisms

- Letters of Credit (LCs): Often preferred for new suppliers or high-value, one-off contracts. An LC provides security by guaranteeing payment upon presentation of compliant shipping and inspection documents.

- Advance Payments: Rare for large, established buyers, but may be negotiated for custom-designed or long-lead-time equipment. These are typically secured by an Advance Payment Guarantee (APG) from the supplier's bank.

- Progress Payments: Common for long-cycle manufacturing projects (e.g., large pressure vessels). Payments are released upon achieving pre-defined milestones (e.g., material procurement, 50% fabrication completion, Factory Acceptance Test (FAT)).

- Retention: A percentage of the final payment (typically 5-10%) is often retained by the buyer for a warranty period (e.g., 12-24 months) after commissioning, serving as a performance bond.

Suppliers should always seek to mitigate risk through robust contractual language and, where possible, utilize trade finance tools to manage cash flow.

The Role of Local Partnerships

Establishing a strong local presence through partnerships is often the fastest and most effective way to address IKTVA requirements and navigate local market dynamics.

Benefits of Local Partnerships

- IKTVA Compliance: A local partner can significantly boost your IKTVA score through local employment and spending.

- Market Access: Local partners possess invaluable knowledge of local business practices, government regulations, and key decision-makers within Aramco and other national oil companies.

- Service and Support: A local presence is essential for providing timely after-sales service, maintenance, and spare parts supply, which is a major factor in Aramco's vendor performance evaluation.

- Tender Eligibility: Some tenders are restricted to local companies or joint ventures with a high local content percentage.

Choosing the right partner—one with a complementary technical focus, a strong reputation, and a clear commitment to IKTVA—is a strategic decision that requires thorough due diligence.

Best Practices for Successful Procurement

Success in the Saudi Arabian oil and gas equipment market hinges on a long-term, compliance-first strategy.

1. Master the SAES and IKTVA Mandates

Dedicate internal resources to fully understand and implement the relevant SAES. Treat IKTVA not as a cost, but as an investment in market access. Your technical and commercial proposals must explicitly demonstrate compliance with both.

2. Prioritize Quality Assurance and Traceability

Saudi Aramco's quality requirements are absolute. Implement a rigorous Quality Control (QC) process that ensures full material traceability, certified welding procedures, and comprehensive documentation packages (Manufacturer’s Data Report - MDR).

3. Streamline the Import Process

Do not underestimate the complexity of SABER. Appoint a dedicated logistics and compliance team or a specialized local agent to manage the PCoC and SCoC process, ensuring all documentation is accurate and submitted well in advance of shipment.

4. Build Relationships with Key Stakeholders

Procurement is relationship-driven. Engage directly with Aramco's engineering and procurement departments, as well as the major EPC contractors. Participate in local industry events, such as the annual IKTVA Forum, to build visibility and network.

5. Focus on After-Sales Service

The ability to provide local, rapid after-sales support, maintenance, and spare parts is a critical differentiator. A local service center or a partnership with a qualified maintenance provider will significantly improve your vendor rating.

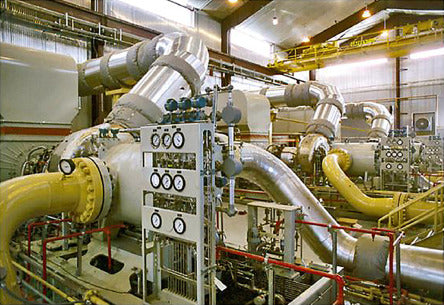

[IMAGE: Photo of a modern industrial facility in Saudi Arabia, symbolizing local manufacturing and IKTVA success.]

Frequently Asked Questions (FAQ)

Q1: What is the single most important factor for a new supplier entering the Saudi O&G market?

A: The single most important factor is achieving Saudi Aramco vendor approval and compliance with Saudi Aramco Engineering Standards (SAES). Without this technical pre-qualification, a supplier cannot participate in major tenders.

Q2: How does the IKTVA program affect international suppliers?

A: IKTVA requires international suppliers to invest in local operations, employment, and R&D. A high IKTVA score is increasingly a prerequisite for winning Aramco contracts, making localization a commercial necessity.

Q3: Is the SABER platform required for all oil and gas equipment?

A: Yes. The SABER platform is mandatory for all imported goods, including industrial equipment. It is used to obtain the Product Certificate of Conformity (PCoC) and the Shipment Certificate of Conformity (SCoC), which are required for customs clearance.

Q4: What is the typical warranty period for industrial equipment in Saudi Aramco contracts?

A: The typical warranty period is 12 months after commissioning or 18-24 months after delivery, whichever comes first. During this period, a financial retention is often held by the buyer to ensure performance.

Q5: What are the primary ports of entry for industrial equipment?

A: The primary ports are King Abdulaziz Port in Dammam (serving the Eastern Province where most oil and gas facilities are located) and Jeddah Islamic Port (serving the Western and central regions).

Q6: Can I use international standards like API or ASME instead of SAES?

A: No. SAES are mandatory. While SAES often incorporate or reference international standards (API, ASME), they frequently add more stringent requirements or specific clauses tailored to the Saudi environment and Aramco's operational needs. Suppliers must comply with the SAES first.

Q7: What is the best way to find a local partner in Saudi Arabia?

A: The best way is through participation in industry events like the IKTVA Forum, utilizing resources from the Saudi Arabian General Investment Authority (SAGIA, now Ministry of Investment), and consulting with specialized business development firms in the Kingdom.

Your Partner for Saudi O&G Equipment Procurement

Navigating the procurement landscape in the Kingdom of Saudi Arabia requires technical excellence, regulatory compliance, and a strategic approach to localization. Partnering with an experienced and reliable supplier is the first step toward securing your success in this dynamic market.

The Power Contractor specializes in providing high-quality, fully compliant industrial equipment, including specialized Riyadh industrial equipment, to the MENA region. We are committed to meeting the stringent quality and technical specifications of major operators like Saudi Aramco, ensuring your projects proceed on schedule and within specification.

We offer:

- Equipment manufactured to international standards and verified for SAES compliance.

- Expert logistics management, including free shipping to MENA region by sea. Air shipping available with additional fees for urgent needs.

- Dedicated support to streamline your procurement and import process.

Contact The Power Contractor today to discuss your equipment needs and localization strategy.

Call-to-Action:

Contact:

* WhatsApp: +86-15706198736

* Email: info@pc-cn.com

* Website: www.pc-cn.com

References:

[1] Saudi Aramco. Supplier Resources. https://www.aramco.com/en/what-we-do/suppliers/supplier-resources

[2] Saudi Aramco. iktva - In-Kingdom Total Value Add. https://www.aramco.com/en/what-we-do/commercial-ecosystems/iktva

[3] The Saudi Gate. SABER Import Regulations and Compliance in Saudi Arabia: A Complete Guide. https://thesaudigate.com/saber-import-regulations-and-compliance-in-saudi-arabia-a-complete-guide/

[4] Saudi Standards, Metrology and Quality Organization (SASO). SABER Platform. https://saber.sa/

[5] Saudi Aramco. Engineering Standards. https://www.aramco.com/ (General information on SAES)